The Breakdown Buy Now, Pay Later Payment Scheme

How Afterpay and the Buy Now Pay Later Dream Impacts Millenials

Interest-free finance, also known as the “buy now, pay later” is a new approach that’s been gaining popularity with shoppers looking to make purchases nowadays. Platforms like Zip, Afterpay, Humm and Openpay allow individuals to spread their expenses on a purchase over time without the need to pay for interest.

The real question we face is how much damage can this do, and what is the reality of buy now pay later when not managed correctly and young people just have a trail of unpaid debt behind them after a shopping spree.

if it all goes wrong and you have a trail of debt behind you. We want to help answer that question here in this overview.

Although interest-free financing isn’t the same as a traditional loan, costs are still inv

+olved here, and it’s always important to know what you’re getting yourself into before you sign up.

In this this article, we’ll outline what the differences are between these buy-now-pay-later platforms, what costs are involved, how they work, why they are appealing, and how they can harm your finances.

What is This Buy Now Pay Later Scheme?

This is a term that is used in referring to providers that offer interest-free credit to people. The buy-now-pay-later scheme has become so popular that many individuals have stopped using credit cards in favour of this more appealing shopping solution.

There are interest-free platforms today that supports this process. Instead of having to pay huge amounts of money upfront, you can spread the cost of the things you want to buy over time.

We provide personal loans for people who need finance, yes we provide a very similar type of service but not in the same way. For a more detailed distinction, you can speak to our finance brokers by contacting us. Yes Loans helps many Afterpay type of customers recover from poorly managed finances after extensive use of buy now pay later type credit systems.

How Does It Work?

The buy-now-pay-later scheme works pretty much the same as the interest-free deals that big retailers have been offering for years. It allows you to delay the payment on your purchases and distributes the expense over a period of time. Doing so makes the cost potentially more manageable for the shopper. The main difference is that you will get your finance from a third-party provider that supports a range of stores compared to obtaining it from one retail outlet.

It works quite the same as a layby. Rather than reserve an item for purchase later, you can get your goods immediately.

In essence, you’ll have to register with a provider, make the purchase and pay back what you have spent. The repayments are often made in standard installments and will be deducted automatically from your selected card. It’s important that your account has sufficient balance to cover the repayment for this scheme.

What’s the Catch with Interest-Free?

The majority of interest-free platforms charge retailers a fee for each transaction. This is how most of them make money. The retailers are able to benefit from the platforms like Zip Pay and Afterpay because they basically let shoppers buy something now and then pay it back later on – which contributes a lot in closing a sale.

Interest-free finance platforms can also make money by charging fees for late repayments. Since these payments are deducted from a shopper’s given account, you are going to be charged a late payment fee in case you are unable to make the repayment or do a reschedule. The fees that are charged for late payments can add up and can send a person to a debt spiral if not handled immediately.

There are some providers that may charge users other fees, which covers things like monthly account-keeping, payment-processing or early exit penalties. Make sure you check the fees that are outlined with a certain provider as charges will be different from one buy-now-pay-later platform to the next.

Who Are the Main Players?

Afterpay

Choose Afterpay as you checkout online or while shopping in-store. Repayment is made in four equal fortnightly instalments for each purchase. You will be charged $10 for late payment fees and an additional $7 if you still haven’t made the repayment by the following week.

The way that this process for how it works reads, it really is as simple as getting finance in 3 steps. The danger is not in the getting finance its the hidden danger of just how easy it is to use finance providers like this and how fast it can all add up.

Source: afterpay.com

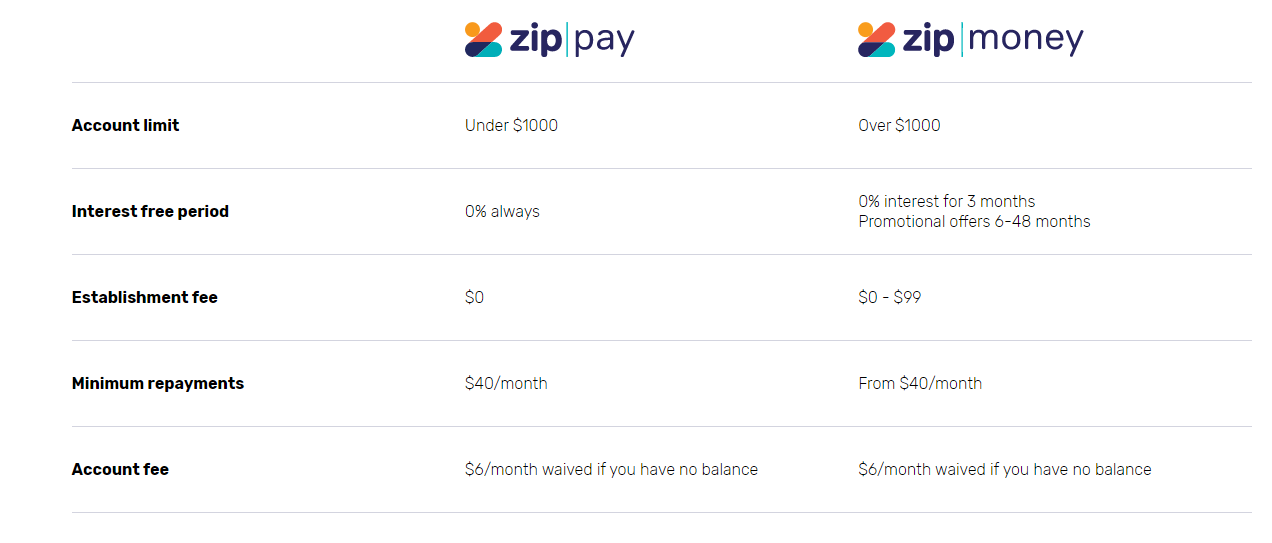

zipMoney

Part of the zip.co group zipMoney is the way to go for larger purchases than $1,000. You can sign up online or during the checkout to get a line of credit that ranges between $1,000 and $30,000. This credit may then be used at any retailer that supports the zipMoney platform. You get 3 months interest-free with a 19.9% p.a. rate which applies after that to the outstanding balance. Late fees apply, and you will need to pay a $6 monthly fee if you have any outstanding balance.

ZipMoney and the Zip group have built a large network of suppliers that can be introduced to customers from the moment that they sign up for an account. This self-feeding ecosystem provides online shoppers inside zipMoney a large collection of assorted goods to shop from all inside the zip.co website.

For smaller purchases, that are below $1,000 you will be using zipPay.

zipPay

Growing rapidly is zipPay a splinter company to zipMoney. ZipPay is designed for smaller purchases under $1,000 making it easy to get what you want today. This company has exploded in growth over the last 18 months offering all the right things to get the Millenials to buy into the fast lifestyle of having everything now.

The signup process is so streamlined it can happen online or during checkout with a credit limit reaching $1,000. The credit line may be applied in any zipPay retailer. They offer a 0% p.a. interest rate with a 60 days fee-free promo for every user. A $6 fee will then apply after this period if you fail to repay your purchase. The fee will have to be paid regularly so long as an outstanding balance remains.

For bigger purchases, the customer will need to use zipMoney.

Source: zip.com

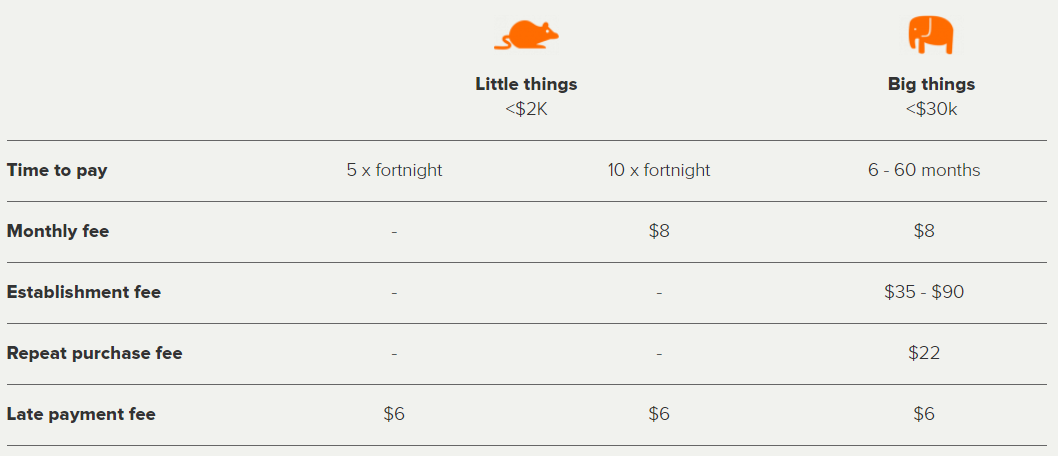

Humm Pay

Users can register online with Humm finance or via their Humm app. The platform can be used at a range of humm stores, and no interest needs to be paid. You can apply up to $30,000 interest-free with terms reaching as long as 60 months. The selling point with Humm finance is that you can buy “little things” up to $2,000 and repay that in 5 or 10 slices a week or you can buy “big things” ranging from $10-30,000 that you can repay over a longer period of time.

Source: shophumm.com.au

While this table shows how easy it is to get the money you want today, the reality is that it still needs to be repaid. The speed at how you can sign up for this platform makes a good cause for concern if your family members are using this. The approach should always be to help educate around the way this platform works, “slicing” it up sounds small but can be a large % of someone’s pay cheque each week.

Openpay

Choose Openpay during checkout online or while you are in-store. You get to make repayments in fortnightly installments. The processing fees can range from $2.50 to $3.95 for longer plans, while late fees are applicable. Openpay stores are growing in numbers and the Millenials are flocking to this platform.

Buy Now Pay Later and Overspending

Research has shown that people have spent more on buy-now-pay-later platforms compared to using credit cards. Majority of them also loved how they can break payments into instalments and get the things they want without having to pay the full price in one go.

The concern here is that around 28% of users have found themselves in trouble financially through these platforms. However, most of those who use buy-now-pay-later have their spending under control.

For users to stay on top of their repayments, it’s crucial that they have a firm idea of the incoming and outgoing in their accounts. It’s also important to understand when the schedules of repayments are to prepare a budget beforehand.

Keep in mind that you will need to pay for a product even months after you have walked out of the shop or pressed the ‘buy now’ button. It’s essential that you consider the probability of receiving poor credit ratings and extra expenses due to late payment fees if you aren’t able to meet the payments on schedule.

Using the Buy Now Pay Later Platforms Responsibly

As with any method of payment or platform, the key to finding success with the buy-now-pay-later scheme is to use it responsibly while having awareness of your spending habit.

Let’s take a look at some tips to help balance your use of such platforms and how to keep things under control.

Plan a budget. The first thing that you need to do is to set a budget. You can spread big expenses for things you need to buy using this scheme so long as you do it the right way. Look at the disposable income you have and consider how much of that you can allocate towards repayment. With proper budgeting, you will less likely overspend and avoid ending up financially burdened later on.

Maintain a statement of your purchases. Keeping a record of everything you’ve bought via the buy-now-pay-later scheme not only helps keep things organised, but you also can keep track of your expenses thus far. You can also view what things you’ve been allocating your income to and identify items you might want to cut back on spending in the future.

Set up reminders for repayments. Although you aren’t paying interest on a buy-now-pay-later platform, missing out on instalments however will bite you back with fees that can add up. That is why it’s important that you set up reminders to keep all of your instalments accomplished at the right schedule.

We wanted to issue our readers to edge on the side of caution if family members were becoming more and more invested in these buy now pay later platforms. One of our key services helps people manage their finances better and we see a lot of return visits from customers who have gone back to these Afterpay type platforms. We do urge caution and suggest speaking with family members about the impact this can have if left unpaid.

Yes Loans is highly rated in debt consolidation and debt management. We provide advice that not only helps you form healthy finance habits but also how to stay on top of all future finance activities.

To speak to one of our finance brokers you can reach them here.