Having to deal with several debts personally can feel like you’re playing a game of cat and mouse – there are different bills with varying due dates to remember with corresponding penalties if you pay up late.

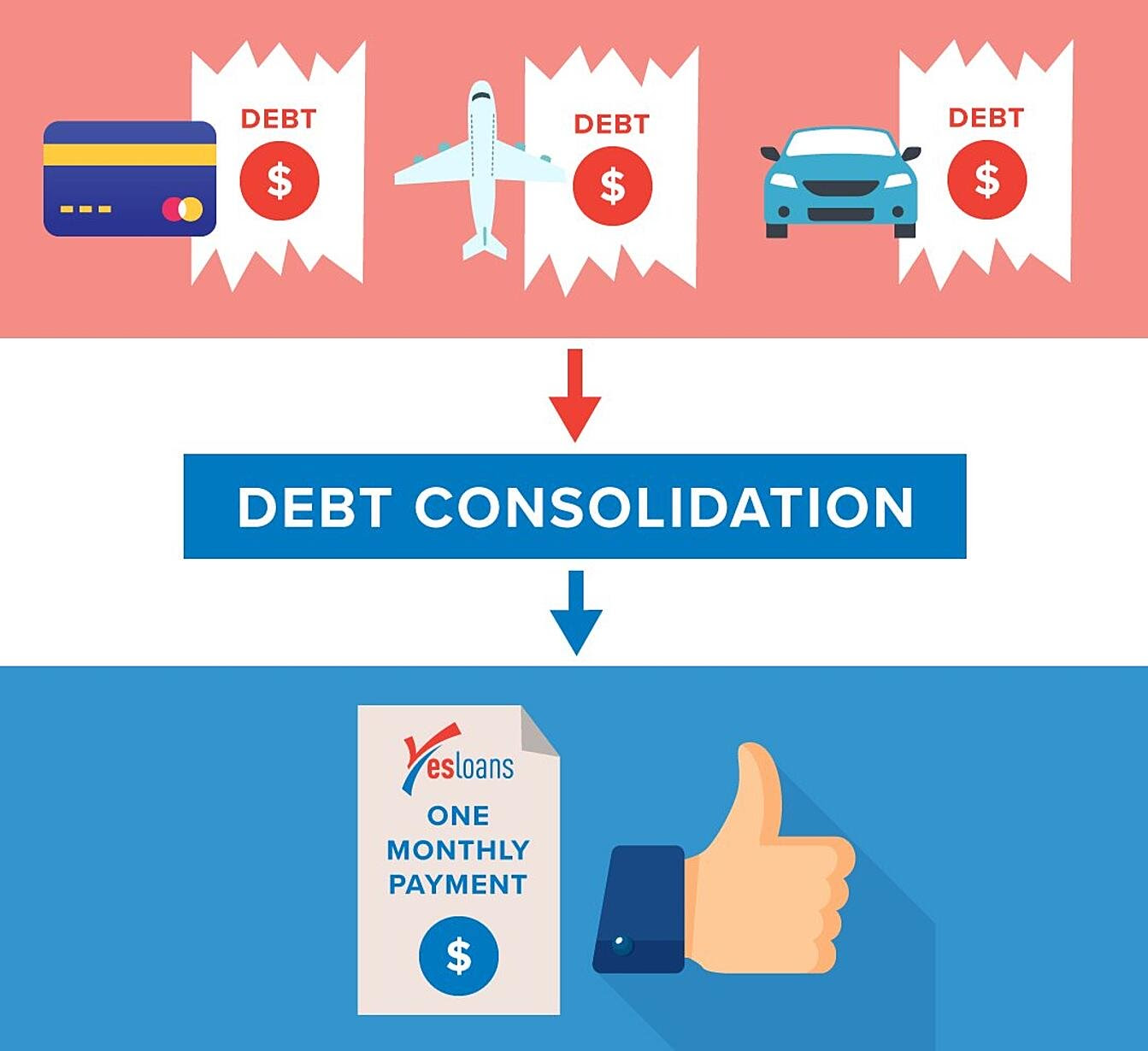

Consolidation of multiple debts into one repayment should reduce your payments and provide the convenience of one loan repayment.

This saves you from having to pay multiple lenders and can often reduce your interest rate. Taking a debt consolidation loan can assist you in putting all of your debt payments such as credit card bills and such into one with a fixed interest rate and a single due date.

As a result of customers having multiple loans, debt management solutions have been introduced that may help to make life easier. One of these tools is a debt consolidation loan.

Debt Consolidation Service in Perth

Consolidation loans can be a useful tool for managing multiple high-interest accounts. This may present a solution for getting your financial affairs under control. We provide the financial strategy that comes with the consolidation loan so you don’t have to worry about being in the same position again in 12 months.

What is a debt consolidation loan?

Debt that gets out of hand can be tough for many people to handle. If you’re in this kind of situation, you can start taking back control of your life and pay your debt sooner. One solution that you can go for is debt consolidation.

Debt consolidation can help you gather all of your debts and put them all in a single loan, hopefully with a lower interest rate than what you’re currently paying. In other words, you’re applying for a single loan that has one regular repayment date, interest rate and a set of loan fees. The goal of getting debt consolidation is to make it more convenient and easier for people to repay all of their existing loans.

Individuals with multiple creditors who are looking for effective ways to pay back loans and other credit have the option of consolidating debt.

When signing up for a consolidation loan that settles an individuals’ multiple debtors, reducing payments from multiple creditors to just one.

There are numerous benefits associated with consolidation loans:

- The terms of the agreement are structured to ensure that the debtor has affordable repayment terms.

- A debt consolidation loan can work out cheaper than multiple credit agreements.

- This usually translates into an increase in one’s monthly cash flow when the loan is taken over a longer term.

- There can be a positive effect on an individual’s credit rating once multiple debts are settled.

- Multiple credit agreements carry multiple interest repayments. Consolidation allows you to reduce loans and eliminates excess interest payments to just one payment.

- Monthly repayments are usually fixed over the lifespan of the credit agreement.

Who should consider a debt-consolidating loan?

The consolidation loan can be a solution for people who pay multiple debts each month. You may also want to take a consolidation loan out to simplify the debt management process. The last thing you want is to be contacted by a debt collector, you shouldn’t just ignore contact from any debt collection agency. What you can do is contact our team at Yes Loans and ask about debt consolidation services to help you take control of your finances.

This is one of the easiest ways to manage debt into one easy repayment plan structured around an individual’s personal affordability.

Dangers of taking out consolidation loans

In principle, a debt consolidation loan should work out cheaper than multiple credit agreements. If this is not the case, the loan should not be considered because it defeats the purpose of the exercise. Such loans are envisioned to bring debt relief for the individual entering into the agreement.

Debt can easily spiral out of control for many individuals. People find themselves taking out loans to settle other debts, creating an endless cycle of indebtedness. Yes Loans offers debt consolidation solutions in Perth. Allow us to assist you with a solution fit for your pocket by structuring a single repayment plan that may address having multiple repayments and high-interest loans.

Our solutions include loan protection options to protect you against the unexpected.

Apply now or contact us to arrange a solution for you.

What Types of Debt Can Be Consolidated?

A debt consolidation loan can be very useful in simplifying nearly any unsecured consumer debt such as:

- Medical Bills

- Credit Card

- Personal Loans

- Car Loans

- Utility Bills

- Taxes

- Student Loans

Reasons Why People Opt for Debt Consolidation Loans

There are several reasons why individuals today choose to go for a debt consolidation loan. The first and foremost among them is that it helps simplifies how they manage their finances. As mentioned earlier, rather than have to pay multiple debts and keep track of each one, you can put this into a single debt which can be paid monthly instead.

Another reason is that it can actually save some people money by lowering their interest rates altogether. This is done by having to pay off high-interest debt with one that is lower through a debt consolidation loan. It’s only possible to achieve this if you have a good credit score and once you have been approved for it.

Life is also a lot easier when you only have to deal with less monthly payments. Many people are already busy with their work and other things in their lives that they don’t want to get stressed over paying bills.

Despite all of these positive reasons, there are still many people who wait until they reach a critical stage before they act on it. That is why their options become limited when this time comes. By taking action right now, people can fix the debts they have and possibly have a better future in doing so.

With the help of Yes Loans, we can provide you with expert advice on whether you should get a debt consolidation loan for your needs. You don’t have to commit to anything when you contact us, there is absolutely no obligation.

Debt Management in Perth

Managing debt has proven to be a challenging task for a lot of people. With personal debt being at an all-time high, individuals are increasingly seeking out ways to effectively manage their debt in order to live uncomplicated lives. Visit our Perth office and speak to our team or visit online and submit a form to start the conversation. We understand it can be hard to speak about but this is what we do and you should speak to a professional about forming a plan moving forward.

What happens when you miss a payment on a debt?

This can happen for a number of reasons and if it happens to you the best advice we can give you is to make it back up as soon as financially possible. If you miss a payment, it is important to sort it as soon as possible. The lending company may contact you with a missed repayment reminder notification that can be avoided by taking the front foot and letting them know a repayment was missed but the payment is expected on this date.

They might also ask if something has happened to cause you to miss a payment and if there is anything they can do to help you to make payments easier.

What is debt refinancing?

Refinancing a personal loan, Credit card or car loan can be an easy debt management tool where existing debt is replaced with a new loan in order to take advantage of new, favourable terms. Essentially, refinancing is taking out a new loan that is used to pay off the existing debt owed to a creditor and replacing the debt with a new one.

- A new credit agreement with lower interest rates brings down the overall debt owed to a creditor.

- In some instances, a debt may be restructured to extend the repayment term, allowing for cheaper payment instalments.

- Consolidating multiple credit agreements into one loan has the potential to bring down monthly repayments and overall interest paid.

Types of loan refinancing

Personal loan refinancing brings debt relief in the instance where someone has multiple credit agreements and wants to consolidate the loans into one payment plan, or to save money.

Loan refinancing is typically done where someone owes the creditor a final balloon or residual amount. Much like other types of refinancing, the final amount owing is settled and broken down into smaller repayments that are more affordable for the debtor.

When done correctly, and for the right reasons, debt refinancing can often be an effective debt management tool.

Understand more what is debt refinancing.

Contact Us for Your Debt Concerns

Don’t lose yourself to debt. Feel like you again with more control over your debt. We can help you implement a debt management plan to get your finance back on track. If you’re interested, send us a message and we can arrange a solution that is right for you.

Our solutions include loan protection options to protect you against the unexpected.

Apply now or contact us to arrange a solution for you.